Consumers Remain Confident About Job Prospects

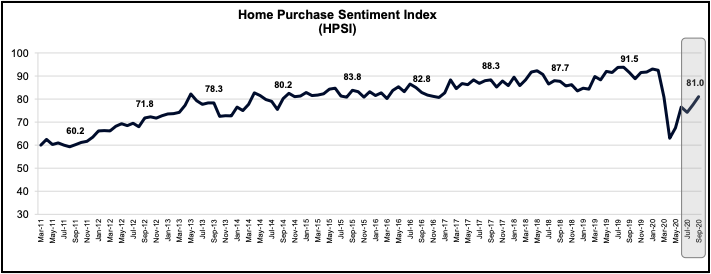

Fannie Mae's Home Purchase Sentiment Index (HPSI) continued to rebound from its spring slide, rising for the second straight month. The HPSI, based on a subset of six questions from the company's monthly National Housing Survey, shows increased optimism about home selling conditions, home price growth and the labor market but that optimism didn't carry forward in September when it came to homebuying conditions and mortgage rate expectations.

The Index increased by 3.5 points in September, to 81.0. However, it is 10.5 points lower than in September 2019.

Despite the huge layoffs and ongoing unemployment insurance claims, most consumers feel secure about their employment prospects. Eighty-three percent of respondents said they were not concerned about losing their job, a 5-point increase and the percent who were concerned dropped 6 points to 16 percent. This left the net up 11 points at 67 percent, only 2 points lower than in the pre-pandemic era a year ago.

Consumer sentiment about buying and selling a home diverged in September. The percentage of respondents who say it is a good time to buy a home decreased 5 points to 54 percent, while the percentage who say it is a bad time increased from 35 percent to 38 percent. As a result, the net share of Americans who say it is a good time to buy decreased 8 percentage points to 16 percent.

Attitudes about selling rose. Those who say it is a good time to sell increased from 48 percent to 56 percent, while the percentage who say it's a bad time to sell decreased from 44 percent to 38 percent. Net positive responses were up 14 percentage points.

The percentage of respondents who say home prices will go up in the next 12 months increased in September from 33 percent to 41 percent, while the percentage who expect those prices to decline fell to 17 percent from 26 percent, leaving the net expecting further increases at 24 percent.

The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 17 percent to 11 percent, while the percentage who expect mortgage rates to go up increased from 33 percent to 38 percent. The share who think mortgage rates will stay the same decreased from 45 percent to 44 percent. As a result, the net share of Americans who say mortgage rates will go down over the next 12 months decreased 11 percentage points.

Finally, 24 percent of respondents reported higher household income than 12 months earlier, down 1 point from August. The percentage who said it was lower increased from 16 to 17 percent and the percentage who said it was unchanged was also unchanged at 59 percent. Thus, the net reporting significantly higher income decreased 2 percentage points to 7 percent.

"The HPSI has recovered more than half of the early pandemic-period decline, mirroring the strong home purchase activity of the past few months," said Doug Duncan, Senior Vice President and Chief Economist. "Consumers' home price expectations were up strongly this month, with high home prices playing an increasingly - though unsurprisingly - important role in driving both the increase in 'good time to sell' sentiment and the decline in 'good time to buy' sentiment. Going forward, we believe the wild card to be whether enough sellers enter the market to continue to meet the strong homebuying demand. The home purchase market requires the proper mix of home price growth and continued economic recovery to achieve sustainable levels of housing activity."

The National Housing Survey from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that are the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts.